Big Thanks to my friend Kedar J. for the compilation!!!

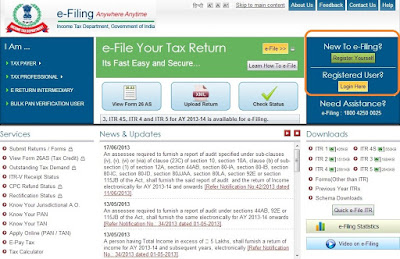

1) Log on to https://incometaxindiaefiling.gov.in/e-Filing/

1) Log on to https://incometaxindiaefiling.gov.in/e-Filing/

If you are first time user, click “Register Yourself” and follow the

process.

Click “Login

Here” if you already have registered and enter your credentials to log in

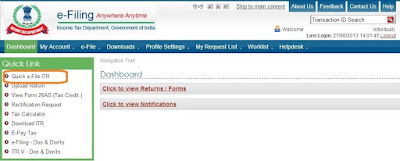

12) Here is what you see after logging in

Click “Quick e-File ITR”

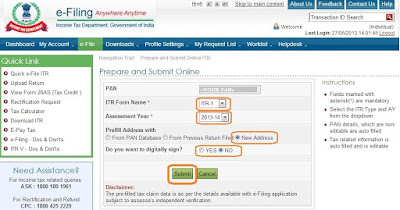

3) You will land in following page

a.

Ensure you have correct PAN

b.

Fill ITR form name – typically ITR-1 for most of

the cases

c.

Assessment Year

= 2013-14

d.

Prefill Address with = “New Address”

e.

Digital sign = NO

f. Click “Submit”

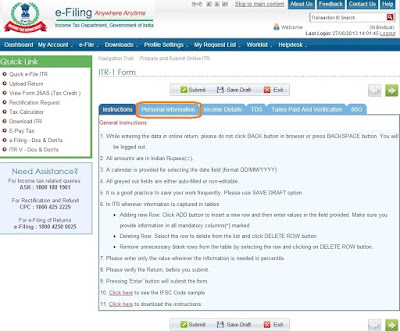

4)

On submitting a details form shows up

5)

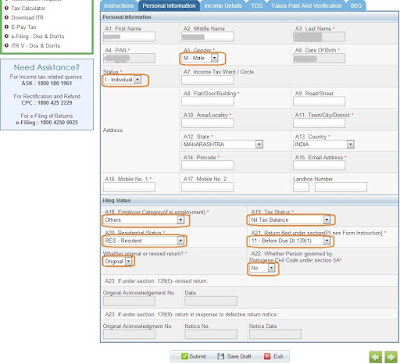

Personal Information

a.

Please fill up the highlighted fields as applicable in “Personal

Information

b. For most of us, the Filing Status section will

be as shown above.

6)

Income Details are to be filled by

individual as per their Form 16

Fill up all the required fiends from Form 16

Fill up all the required fiends from Form 16

7)

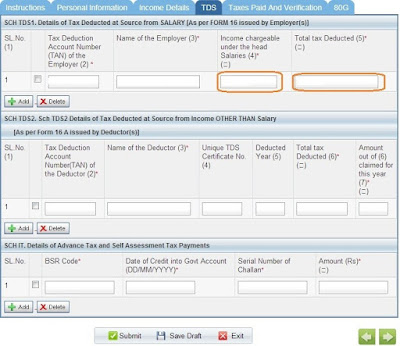

Now the TDS section

Only following fields are to be filled from Form 16

Only following fields are to be filled from Form 16

a. Income chargeable under the head

“Salaries”

b. Total tax deducted

8)

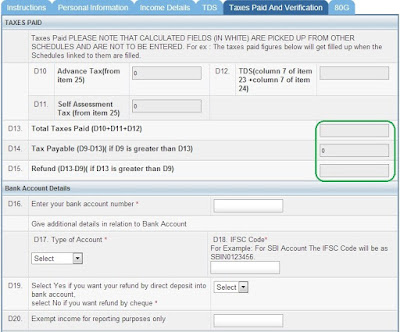

Taxes Paid And Verification

a. Ensure the green outlined fields are

appropriate.

9)

Submission process

·

Keep

‘Saving the draft’ to save your changes

·

Finally

once everything is filled, click the “Submit” button.

10)

What next?

·

Wait

till you get the email from income tax department.

·

Open

the PDF in the email’s attachment, (which has password: <PANDOB>

·

Take

a printout of that PDF doc (of course after carefully verifying everything)

·

Sign

it and post it to the address given on that doc. (don’t forget to affix Rs. 10

stamps)

No comments:

Post a Comment